Ginkgo Trust Legacy

Family Trust Lectures

銀杏信託傳承基金會最新講座資訊

The Ginkgo Trust Legacy Foundation, in conjunction with like-minded organizations such as the Taipei American Trust Legacy Association, Alishan Charity, Tata Charity, the North American Association of Chinese Accountants, and KEDP Associates, organizes international trust heritage seminars and other activities to highlight the rich heritage left to us by our ancestors, and to express our dedication to tracing the roots of our cultural heritage.

Offshore Trust Related Tax Liability and Self-Audit

Lecture Time 2023-5-30 09:00 ~ 10:00

Lecture Time 2023-5-30 09:00 ~ 10:00

This seminar series is organized by the American Trust Legacy Association of Taipei City and Ginkgo Trust Legacy Foundation, in collaboration with Alishan Charity (USA) and TATA Charity (USA). John Liu and Tony Liu, who have many years of experience in trust planning, were invited to explain the tax responsibilities of the U.S. settlor and beneficiary of an offshore trust and how to use the medical examination form to review whether an offshore trust needs to be amended.

* John Liu, U.S. Accountants

* Tony Liu, U.S. Accountants

* John Liu, U.S. Accountants

* Tony Liu, U.S. Accountants

Structure of Irrevocable Trust

Lecture Time 2023-4-25 09:00 ~ 10:00

Lecture Time 2023-4-25 09:00 ~ 10:00

This seminar series is organized by the Taipei City American Trust Legacy Association and Ginkgo Trust Legacy Foundation, in collaboration with Alishan Charity (USA) and TATA Charity (USA). Roy Pan and Tony Liu, who have many years of experience in trust planning, were invited to explain the benefits of irrevocable trusts for asset planning and future tax reporting.

* Tony Liu, U.S. Accountants

* Roy Pan, U.S. Accountants

* Tony Liu, U.S. Accountants

* Roy Pan, U.S. Accountants

Revocable trust structure and tax reporting

Lecture Time 2023-2-21 09:00 ~ 11:00

Lecture Time 2023-2-21 09:00 ~ 11:00

This seminar series is organized by Taipei American Trust Legacy Association and Ginkgo Trust Legacy Foundation, and co-sponsored by Alishan Charity (USA) and TATA Charity (USA), and features John Liu and Roy Pan, U.S. accountants with years of experience in trust planning at Amgen & Associates, explaining the benefits of revocable trusts for asset planning and related issues in the future.

* John Liu, U.S. Accountants

* Roy Pan, U.S. Accountants

* John Liu, U.S. Accountants

* Roy Pan, U.S. Accountants

Cross-Border Succession Tools: The Practicalities of U.S. Trust Formation

This seminar series is organized by the Taipei City American Trust Legacy Association and the Ginkgo Trust Legacy Foundation, and co-sponsored by Alishan Charity (USA) and TATA Charity (USA), with a strong team of U.S. accountants and attorneys from Anslow & Associates to explain the benefits of setting up an irrevocable trust for asset planning in the U.S.

Time

2022-12-27 09:00 ~ 11:00

Speaker

* Tony Liu, CPA, USA: Irrevocable Trust Structure* Sherry Liu, U.S. Attorney: Irrevocable Trust Contract

* Johnathan Hsu, CPA, USA: Irrevocable Trust Tax Reporting

* John Liu, CPA, USA: Q & A

* Johnathan Hsu, CPA, USA: Irrevocable Trust Tax Reporting

* John Liu, CPA, USA: Q & A

Wealth Planning Benefits of Private Foundation in the U.S.

Tim Chang, a partner in the Los Angeles office of Musick, Peeler & Garrett LLP, will be our guest speaker to explain the threshold for setting up a private foundation in the United States and the benefits it can bring to high-asset families in planning their wealth. Max Lu, a Cornell University business school graduate who is currently a registered investment advisor and has passed the U.S. CPA exam, will speak with the guests.

Time

2022-11-22 09:00 ~ 11:00

Speaker

Tim Chang, Partner, Los Angeles Office, Musick, Peeler & Garrett LLP

2022-10-25 09:00 ~ 11:00

Business valuation related

Information and updates

Information and updates

The Association, in collaboration with Alishan Charity (USA) and TATA Charity (USA), will host a series of seminars with Jerry Lin, an international business appraiser from Lean Consulting Group and a former professor at Cal State LA, to explain the latest developments in business valuation. Max Lu, a Cornell University business school graduate and current U.S. registered investment advisor who has passed the U.S. CPA exam, will be our guest speaker; John Liu and Roy Pan, AICPAs, will analyze the actual situation such as trust transfers and gifts and the IRS approach to valuation reporting.

Speaker

Jerry Lin, former professor at California State University, Los Angeles

2022-08-30 08:00 ~ 10:00

US Immigration Tax &

Family Succession Planning

Family Succession Planning

The Association, in collaboration with Alishan Charity (USA) and TATA Charity (USA), will host a series of seminars with Danny Chen, an immigration attorney from Green Maple Law, to explain the latest status of immigration to the U.S. Max Lu, a Cornell University business school graduate who is currently a registered investment advisor and has passed the U.S. CPA exam, will talk to our guests. Max Lu, a graduate of Cornell University School of Business and a certified investment advisor who has passed the U.S. CPA exam, will talk with the guests; John Liu and Roy Pan, U.S. CPAs, will give insight into tax planning before immigration.

Speaker

Guest speaker will be immigration attorney Danny Chen of Green Maple Law.

2022-06-28 08:00 ~ 10:30

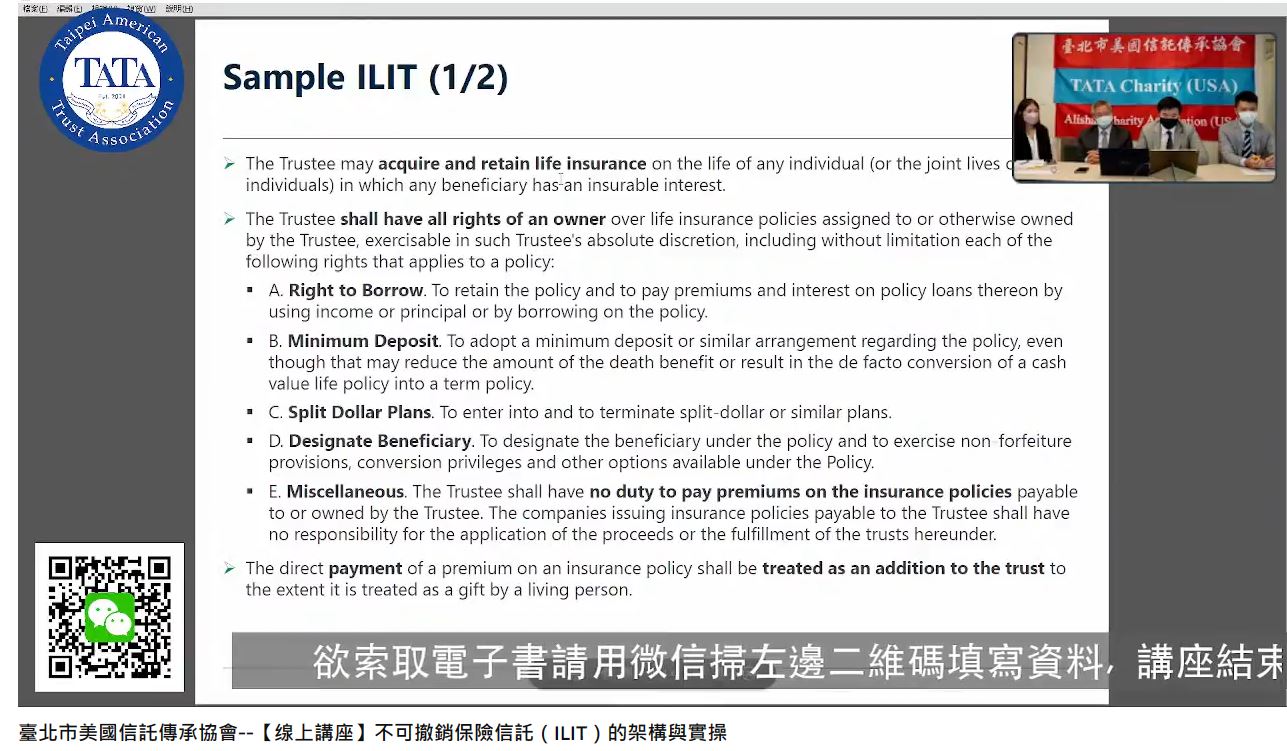

The Structure and Operation of

Irrevocable Insurance Trust (ILIT)

Irrevocable Insurance Trust (ILIT)

The Association, in collaboration with Alishan Charity (USA) and TATA Charity (USA), will invite Tony Yu, a US attorney and President of DSG Yongdae Group, to be our guest speaker to explain the tax-related issues that may be involved in planning a policy under a trust; Max Lu, a Cornell University business school graduate and currently a US registered investment advisor who has passed the US CPA exam, will be our guest speaker. John Liu, AICPA, will explain the theory and structure of designing an irrevocable insurance trust, and Megan Chen, a cross-border wealth planner, will explain how to open and maintain a bank account today to ensure the smooth operation of funds.

2022-05-31 08:00 ~ 10:30

Foreign Trusts with U.S. Persons

The Association, in collaboration with Alishan Charity (USA) and TATA Charity (USA), will invite Daniel Hayward, a U.S. trust attorney from GF&M, to be our guest speaker to give an insightful analysis of the advantages and disadvantages of offshore trusts and U.S. trusts for Chinese. Max Lu, a graduate of Cornell University School of Business and currently a registered investment advisor in the U.S. who has passed the U.S. CPA examination, will discuss with the guests; John Liu, a U.S. CPA, will explain in detail the structure of the offshore trust into the U.S. trust; and Mindy Wu, a U.S. CPA, will explain the initial billing accounting principles of the U.S. trust.

Speaker

Daniel Hayward, a U.S. trust lawyer from GF&M, will be our guest speaker.

2022-04-19 08:55 ~ 11:30

U.S. Irrevocable Trusts for

Non-U.S. Person Settlors

Non-U.S. Person Settlors

The Association, in collaboration with Alishan Charity (USA) and TATA Charity (USA), will host a series of seminars with Daniel Hayward, a U.S. trust lawyer from GF&M, introducing the most common types of directive trusts, dynasty trusts and asset protection trusts set up by Chinese people. Max Lu, a graduate of Cornell University School of Business, is currently a registered investment advisor in the US and has passed the US CPA examination.

Speaker

Daniel Hayward, a U.S. trust lawyer from GF&M, will be our guest speaker.

Key Speakers

Legacy -- Trust & Ginkgo

This channel is not for profit, but to promote Chinese family legacy - to pass on wealth through American dynasty trusts; to symbolize family spirit through the thousand year old Ginkgo tree, so that the future generations who enjoy the freedom of wealth will not forget the first or second generation who created the wealth. It is not investment advice, and investment involves risks, so investors need to make independent judgment and bear their own profits and losses. This channel is divided into the following three types of videos: 1. Taipei American Trust Association Seminars "Taipei American Trust Association" President Lu Xu-Ming hopes to promote the general public and professionals' understanding of the U.S. Trust from a public welfare perspective, and to understand that family asset planning is no longer limited to traditional financial tools, but more importantly, forward-looking and comprehensive planning. Through our seminars, you will gain a deeper understanding of why the U.S. Trust is such a powerful tool for cross-border family wealth planning! 2. Inheritance Token: Ginkgo 3.

Volunteer of the Month

【CANADA / London】

Special thanks to Mr. DeLuca for gifting the ginkgo trees.

Join Our Newsletter

Motivation The Defining Moment Of Self Improvement